In this article, we will explore the future share price targets of IFCI for the years 2025, 2026, 2028, 2030, 2040, and 2050. Additionally, we will discuss IFCI’s fundamentals, market sentiment, financial performance, and quarterly reports to assist investors in making informed decisions.

About IFCI

IFCI is a key public-sector financial institution in India. Established in 1948, it operates as a non-deposit taking non-banking finance company (NBFC-ND-SI). IFCI has six subsidiaries and one associate, focusing on industrial development. It funds projects in sectors like infrastructure, real estate, manufacturing, and services. Major projects supported by IFCI include Adani Mundra Ports, GMR Goa International Airport, and Salasar Highway.

The organization also acts as a project management agency (PMA) for production-linked incentive (PLI) schemes under the “Atmanirbhar Bharat” initiative. This program promotes domestic manufacturing. Additionally, IFCI provides financial, ESG, and project advisory services to corporates.

IFCI Fundamentals

| Description | Value |

|---|---|

| Company Name | IFCI Ltd. |

| Sector | Finance |

| Established | 1948 |

| Website | ifciltd.com |

| Listing At | BSE, NSE |

| BSE Code | 500106 |

| NSE Code | IFCI |

| Mkt Cap | ₹17542Cr |

| Reserves and Surplus | ₹-1775.41Cr |

| ROE | 2.14% |

| ROCE | 10.2% |

| 52 Week High | ₹91.40 |

| 52 Week Low | ₹68.40 |

| P/E Ratio (TTM) | 139.83 |

| Industry P/E | 18.86 |

| P/B Ratio | 2.99 |

| Face Value | 10 |

| Book Value Per Share | ₹22.43 |

| EPS (TTM) | ₹0.48 |

| Dividend Yield | 0.00% |

| Debt to Equity | 0.86 |

| Total Revenue | ₹2115Cr |

| Revenue Growth | 22.39% |

| Net Profit (Anual) | ₹241.05Cr |

| Profit Growth | 301.24% |

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2023 | 111.23% |

| 2022 | -15.08% |

| 2021 | 77.60% |

| 2020 | 38.64% |

| 2019 | -55.85% |

| 2018 | -51.46% |

| 2017 | 13.24% |

| 2016 | -1.45% |

| 2015 | 27.08% |

| 2014 | 47.28% |

| 2013 | -23.28% |

| 2012 | 53.32% |

| 2011 | -67.53% |

| 2010 | -23.71% |

IFCI Share Price Target 2025

Current market sentiment around IFCI is bullish. The expected share price target for 2025 is estimated to be between ₹40 to ₹120.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹40 | ₹120 |

IFCI Share Price Target 2026

According to market analysts, IFCI’s share price in 2026 is projected to range between ₹70 to ₹155.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹70 | ₹155 |

IFCI Share Price Target 2028

By 2028, the share price target for IFCI is anticipated to be between ₹140 to ₹210, considering the company’s steady growth and expansion in defense contracts.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹140 | ₹210 |

IFCI Share Price Target 2030

Based on the company’s historical performance and ongoing projects, IFCI’s share price in 2030 is expected to be between ₹290 to ₹350.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹290 | ₹350 |

IFCI Share Price Target 2040

Following the long-term trend, IFCI’s share price in 2040 is likely to fall between ₹960 to ₹1090.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹960 | ₹1090 |

IFCI Share Price Target 2050

Considering the consistent growth trajectory and the company’s prominent role in defense manufacturing, IFCI’s share price target for 2050 is expected to range from ₹1900 to ₹2100.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹1900 | ₹2100 |

IFCI Share Price Target: Export Opinion

Latest News

On Monday, IFCI Ltd shares jumped 14.7%, reaching an intraday high of Rs 66.59 on the BSE. This surge came after the board approved consolidating IFCI Group companies.

Strengths

- Revenue has grown by 22.39% compared to the previous year, the highest growth in four years.

- Net cash flow and cash from operating activities have improved.

- Annual EPS growth is strong.

- The operating profit margin remains above 80% in recent quarters.

- The net profit margin was 11.38% in FY 2024, showing positive performance.

- The debt-to-equity ratio is well-managed at 0.86.

- Promoters hold 71.72% of the company’s stake, ensuring management stability.

Risks

- Negative reserves of ₹-1,775.41 crore reflect past financial struggles.

- The P/E ratio is 139.83, significantly above the industry average, indicating overvaluation risks.

- Quarterly net profit margins are inconsistent, raising concerns about earnings stability.

- Performance has declined over the last two quarters.

- Return on equity (ROE) is very low, suggesting limited returns for shareholders.

- Net profit margin was negative in three of the last four quarters.

- The company hasn’t declared dividends in recent years, reducing investor returns.

- It operates in a highly competitive industry.

- Except for FY 2024, the company has reported losses for the last three years.

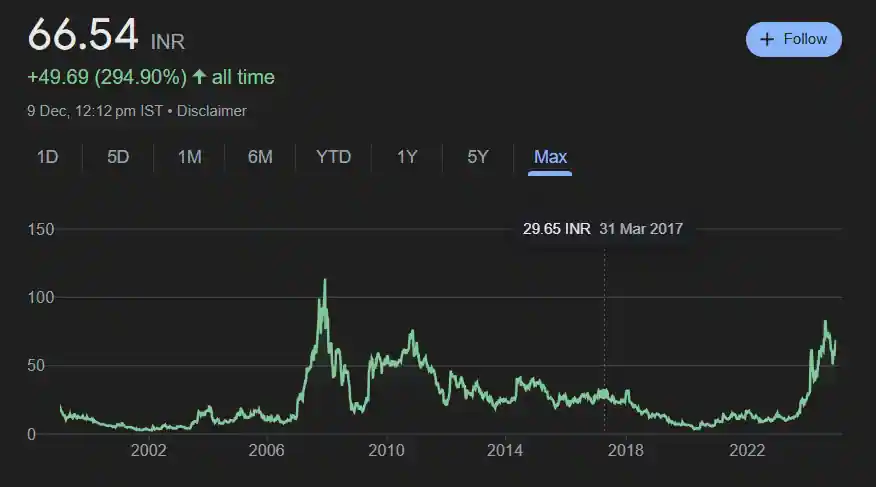

IFCI Share Price History

IFCI Quarterly Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec 23 |

| Revenue + | ₹300.63Cr. | ₹123.19Cr. | ₹436.26Cr. | ₹215.70Cr. |

| Expenses + | ₹300Cr | ₹159.22Cr. | ₹107.74Cr. | ₹190.97Cr. |

| EBITDA | ₹6.06Cr | ₹6.05Cr. | ₹6.05Cr. | ₹6.05Cr. |

| EBIT | ₹136.69Cr | ₹98.36Cr. | ₹474.74Cr. | ₹168.54Cr. |

| Net Profit | ₹-21.56Cr | ₹-148.24Cr. | ₹215.51Cr. | ₹-10.06Cr. |

| Operating Profit Margin | 89.37% | 85.32% | 125.57% | 81.30% |

| Net Profit Margin | -13.50% | -121.13% | -4.68% | -% |

| Earning Per Share | ₹-0.08 | ₹-0.57 | ₹0.87 | ₹-0.04 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 0.00 |

IFCI Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹2115Cr | ₹1728Cr | ₹1596Cr | ₹2094Cr |

| Total Expenses | ₹1367Cr | ₹1701Cr | ₹3118Cr | ₹4181Cr |

| Profit/Loss | ₹241.05Cr | ₹-119.78Cr | ₹-1761Cr | ₹-1912Cr |

| Net Profit Margin | 11.38% | -6.93% | -110.37% | -91.19% |

| Earning Per Share | ₹0.42 | ₹-0.95 | ₹-8.71 | ₹-10.24 |

| EBITDA | ₹1403 | ₹741.63 | ₹-513.85 | ₹-865.17 |

| EBIT | ₹1322 | ₹667.70 | ₹-580.24 | ₹-937.56 |

| Operating Profit Margin | 66.24% | 42.91% | -32.20% | -41.27% |

| Dividends Per share | 0.00 | 0.00 | 0.00 | 0.00 |

IFCI Cash Flow

| Particulars | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Opening Cash Balance | ₹110.38Cr. | ₹110.38Cr. | ₹112.43Cr. | ₹0.00Cr. |

| Cash Flow From Operating Activities | ₹32.42Cr | ₹32.42Cr. | ₹-483.40Cr. | ₹0.00Cr. |

| Cash Flow From Investing Activities | ₹-0.34Cr | ₹-0.34Cr. | ₹-18.65Cr. | ₹0.00Cr. |

| Cash Flow From Financing Activities | ₹500Cr | ₹500Cr. | ₹500Cr. | ₹0.00Cr. |

| Closing Cash Balance | ₹642.46Cr | ₹642.46Cr. | ₹110.38Cr. | ₹0.00Cr. |

| Net Change In Cash | ₹532.08 | ₹532.08 | ₹-2.05 | ₹0.00 |

IFCI Share Price Target 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2023 | ₹270 | ₹620 |

| 2024 | ₹20 | ₹80 |

| 2025 | ₹40 | ₹120 |

| 2026 | ₹70 | ₹155 |

| 2028 | ₹140 | ₹210 |

| 2030 | ₹290 | ₹350 |

| 2040 | ₹960 | ₹1090 |

| 2050 | ₹1900 | ₹2100 |

IFCI Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 71.72% |

| Other Domestic Institutions | 1.56% |

| Retail and Others | 24.06% |

| Foreign Institutions | 2.54% |

| Mutual Funds | 0.011% |

| Total | 100.00% |

How to Buy IFCI Shares?

Buying and selling of IFCI can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

IFCI Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Bharti Airtel | ₹9.86 LCr. | 60.54% | ₹960 | ₹1789 |

| Bharti Hexacom | ₹69.33 KCr. | 69.56% | ₹755 | ₹1568 |

| Railtel Corporation of India | ₹12.80 KCr. | 45.39% | ₹273.75 | ₹617.80 |

| Vodafone Idea | ₹48.61KCr | -36.98% | ₹6.61 | ₹19.18 |

| Nazara Technologies | ₹7.11 KCr | 25.67% | ₹591.50 | ₹1117 |

| Hathway Cable and Datacom | ₹3.23 KCr. | 12.20% | ₹14.82 | ₹27.95 |

| Nelco | ₹2.32 KCr | 38.38% | ₹642.55 | ₹1335 |

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| Adani ports | ₹3.11 LCr | 94.78% | ₹703.00 | ₹1,457.05 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Havells India | ₹1.20 LCr | 41.69% | ₹1232.85 | ₹1950.05 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

IFCI has shown notable progress in profitability and operational efficiency. However, risks like high valuation, negative reserves, and unstable profits cannot be ignored. The company’s history of losses has affected investor confidence. It could be a viable option for long-term investment, but investors should monitor its earnings stability and efforts to improve financial reserves.

Disclaimer: The information provided here is for general informational purposes only and should not be considered as financial advice. Before making any investment, it is advisable to consult with a certified financial advisor. The author is not responsible for any investment decisions made based on this article.

Also Read:

FAQs

Q1. What is the IFCI share price target for 2025?

Ans: The expected share price target for IFCI in 2025 is between ₹40 to ₹120.

Q2. What is the IFCII share price target for 2030?

Ans: IFCI’s share price target for 2030 is projected to be between ₹290 to ₹350.

Q3. What is the IFCI share price target for 2040?

Ans: The share price target for IFCI in 2040 is expected to be between ₹960 to ₹1090.

Q4. What is the IFCI share price target for 2050?

Ans: IFCI’s share price target for 2050 is likely to range between ₹1900 to ₹2100.