In this article, we will explore the future share price targets of NHPC for the years 2025, 2026, 2028, 2030, 2040, and 2050. Additionally, we will discuss NHPC’s fundamentals, market sentiment, financial performance, and quarterly reports to assist investors in making informed decisions.

About NHPC

NHPC Limited is a public sector company in India established in 1975. It is India’s largest hydroelectric power producer. It is headquartered in Faridabad, Haryana. NHPC develops and operates hydropower plants and plans, designs and maintains projects. It also works in the field of solar energy and wind energy for clean and renewable energy.

As of 31 December 2024, the total capacity of NHPC is 7232.90 MW for which 22 hydropower stations, five solar power projects and one wind power project have been established. It is working on 16 projects to install 10804 MW capacity including its joint venture. These include 3 hydropower projects, 6 solar power projects, 6 hydropower projects and one solar project. Apart from this, approval is going to be received for 9 projects for 4291 MW.

NHPC Fundamentals

| Description | Value |

|---|---|

| Company Name | NHPC Ltd. |

| Sector | Power Generation and Distribution |

| Established | 7 November 1975 |

| Website | nhpcindia.com |

| Listing At | BSE, NSE |

| BSE Code | 533098 |

| NSE Code | NHPC |

| Mkt Cap | ₹77256Cr |

| Reserves and Surplus | ₹27223.58Cr |

| ROE | 9.61% |

| ROCE | 7.67% |

| 52 Week High | ₹118.40 |

| 52 Week Low | ₹72.15 |

| P/E Ratio (TTM) | 25.90 |

| Industry P/E | 22.66 |

| P/B Ratio | 1.92 |

| Face Value | 10 |

| Book Value Per Share | ₹39.97 |

| EPS (TTM) | ₹2.97 |

| Dividend Yield | 2.47% |

| Debt to Equity | 0.85 |

| Total Revenue | ₹10994Cr |

| Revenue Growth | -2.58% |

| Net Profit (Anual) | ₹3633Cr |

| Profit Growth | -15.02% |

Also Read: Solarium Green Energy Share Price Target 2025, 2026, 2030

Returns in Past Year

| Year | Returns (%) |

|---|---|

| 2024 | 24.91% |

| 2023 | 62.52% |

| 2022 | 28.43% |

| 2021 | 36.64% |

| 2020 | -5.43% |

| 2019 | -7.88% |

| 2018 | -20.37% |

| 2017 | 23.44% |

| 2016 | 25.65% |

| 2015 | 11.67% |

| 2014 | -3.58% |

| 2013 | -23.58% |

| 2012 | 41% |

| 2011 | -35.99% |

| 2010 | -17.18% |

NHPC Share Price Target 2025

Current market sentiment around NHPC is highly bearish. The expected share price target for 2025 is estimated to be between ₹48 to ₹120.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹48 | ₹120 |

NHPC Share Price Target 2026

According to market analysts, NHPC’s share price in 2026 is projected to range between ₹70 to ₹140.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2026 | ₹70 | ₹140 |

NHPC Share Price Target 2028

By 2028, the share price target for NHPC is anticipated to be between ₹120 to ₹213, considering the company’s steady growth and expansion in defense contracts.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2028 | ₹120 | ₹213 |

NHPC Share Price Target 2030

Based on the company’s historical performance and ongoing projects, NHPC’s share price in 2030 is expected to be between ₹160 to ₹276.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2030 | ₹160 | ₹276 |

NHPC Share Price Target 2040

Following the long-term trend, NHPC’s share price in 2040 is likely to fall between ₹450 to ₹646.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2040 | ₹450 | ₹646 |

NHPC Share Price Target 2050

Considering the consistent growth trajectory and the company’s prominent role in defense manufacturing, NHPC’s share price target for 2050 is expected to range from ₹736 to ₹1056.

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2050 | ₹736 | ₹1056 |

Also Read: Ola Electric share price target 2025, 2026, 2028, 2030, 2040, and 2050

NHPC Share Price Target: Export Opinion

Strengths

- Operating cash flow in 2024 stood at ₹6,938 crore, ensuring liquidity for operations.

- Net profit margin has averaged 40% in recent years, indicating operating efficiency.

- EBITDA and operating profit margins are stable above 65%, reflecting strong core operations.

- The last 4 quarters have seen an increase in the company’s operating profit margin.

- The promoter holds 67.40% stake, which instills investor confidence.

- Domestic and foreign institutions hold around 14.44% stake, which reflects institutional confidence.

- Its revenue has increased over the last 2 quarters.

- The company pays dividends consistently, benefiting long-term investors seeking income.

- With reserves of ₹27,223.58 crore, NHPC is well positioned to invest in growth or to meet unforeseen challenges.

Risks

- Revenue and profit declined by 2.58% and 15.02%, respectively, in 2024, reflecting challenges in expanding operations or controlling costs.

- The company is not optimally utilising assets to generate profits

- NHPC operates only in the power sector, making it vulnerable to policy changes, renewable energy shifts or regional disruptions.

- MACD is below the signal line.

- The debt-to-equity ratio of 0.85 is a bit high for comfort and finances could come under pressure if earnings decline.

- September 2024 saw a decline in quarterly profit compared to previous quarters.

- Any macroeconomic issues, such as rising interest rates or inflation, could increase financing costs and impact profitability.

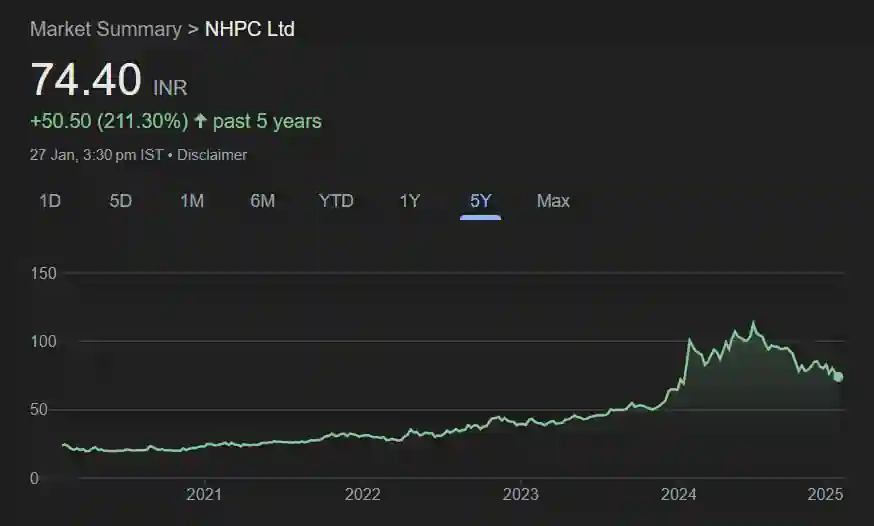

NHPC Share Price History Chart

NHPC Quarterly Income Report

| Description | Sep 24 | Jun 24 | Mar 24 | Dec23 |

| Revenue + | ₹2922Cr. | ₹2786Cr. | ₹2242Cr. | ₹2318Cr. |

| Expenses + | ₹1689Cr | ₹1513Cr. | ₹1285Cr. | ₹1638Cr. |

| EBITDA | ₹1802Cr | ₹1783Cr. | ₹1333Cr. | ₹1059Cr. |

| EBIT | ₹1531Cr | ₹1502Cr. | ₹1052Cr. | ₹781.18Cr. |

| Net Profit | ₹905.25Cr | ₹1024Cr. | ₹697.76Cr. | ₹546.13Cr. |

| Operating Profit Margin | 71.89% | 76.18% | 90.60% | 63.81% |

| Net Profit Margin | 35.48% | 42.33% | 42.25% | 32.18% |

| Earning Per Share | ₹0.90 | ₹1.02 | ₹0.69 | ₹0.54 |

| Dividends Per Share | 0.00 | 0.00 | 0.00 | 1.40 |

NHPC Annual Income Report

| Description | Mar 24 | Mar 23 | Mar 22 | Mar 21 |

|---|---|---|---|---|

| Total Revenue | ₹10994Cr | ₹11285Cr | ₹10108Cr | ₹10711Cr |

| Total Expenses | ₹6350Cr | ₹6028Cr | ₹5679Cr | ₹6138Cr |

| Profit/Loss | ₹3633Cr | ₹4275Cr | ₹4984Cr | ₹3488Cr |

| Net Profit Margin | 41.70% | 40.04% | 41.14% | 37.24% |

| Earning Per Share | ₹3.61 | ₹3.89 | ₹3.51 | ₹3.26 |

| EBITDA | ₹6234 | ₹6941 | ₹6150 | ₹6247 |

| EBIT | ₹5050 | ₹5726 | ₹4960 | ₹4955 |

| Operating Profit Margin | 70.76% | 65.09% | 54.43% | 65.84% |

| Dividends Per share | 1.90 | 1.85 | 1.81 | 1.60 |

NHPC Cash Flow

| Particulars | 2024 | 2023 | 2022 | 2021 |

|---|---|---|---|---|

| Opening Cash Balance | ₹1034Cr. | ₹1316Cr. | ₹447.27Cr. | ₹42.17Cr. |

| Cash Flow From Operating Activities | ₹6938Cr | ₹4705Cr. | ₹4590Cr. | ₹5070Cr. |

| Cash Flow From Investing Activities | ₹-5968Cr | ₹-4191Cr. | ₹-3084Cr. | ₹-1607Cr. |

| Cash Flow From Financing Activities | ₹-581.48Cr | ₹-794.57Cr. | ₹-638.36Cr. | ₹-3058Cr. |

| Closing Cash Balance | ₹1422Cr | ₹134Cr. | ₹1315Cr. | ₹447.27Cr. |

| Net Change In Cash | ₹387.87 | ₹-281.35 | ₹867.40 | ₹405.10 |

NHPC Share Price Target 2025, 2026, 2028, 2030, 2040 to 2050

| Year | Price Target (Min) | Price Target (Max) |

|---|---|---|

| 2025 | ₹48 | ₹120 |

| 2026 | ₹70 | ₹140 |

| 2028 | ₹120 | ₹213 |

| 2030 | ₹160 | ₹276 |

| 2040 | ₹450 | ₹646 |

| 2050 | ₹736 | ₹1056 |

NHPC Shareholding Pattern

| Shareholder | Share % |

|---|---|

| Promoter | 67.40% |

| Other Domestic Institution | 5.66% |

| Retail and Others | 13.78% |

| Foreign Institution | 8.78% |

| Mutual Funds | 4.38% |

| Total | 100.00% |

How to Buy NHPC Shares?

Buying and selling of NHPC can be done by a stock broker registered with SEBI. Here are the names of some popular brokers.

- Zerodha

- groww

- Angel One

- upstox

NHPC Similar Stocks

| Company Name | Mkt Cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| SJVN power | ₹38.56KCr. | -5.35% | ₹95.34 | ₹98.75 |

| Reliance Power | ₹15.92KCr. | 39.12% | ₹39.31 | ₹40.54 |

| Transrail lighting | ₹7.47 KCr. | 0.21% | ₹552.90 | ₹576.70 |

| Tata Power | ₹1.16 LCr. | 4.71% | ₹355.10 | ₹365.90 |

| JP Power | ₹11.09KCr | 1.82% | ₹16.08 | ₹16.41 |

| Waaree Renewables | ₹10.59 KCr | 60.90% | ₹960 | ₹1034.95 |

| Rattan Power | ₹6.79 KCr. | 27.04% | ₹12.45 | ₹13.04 |

| Urja Global | ₹846.82 Cr | -11.10% | ₹14.53 | ₹41.65 |

| Adani Power | ₹2.01LCr. | 0.90% | ₹518.70 | ₹537.95 |

| SW Solar | ₹8.31KCr. | -31.86% | ₹354.30 | ₹372.45 |

Profitable Stocks

| Stocks | Mkt cap | Profit (1Year) | 52W L | 52W H |

|---|---|---|---|---|

| TCS | ₹1544LCr | 14.87% | ₹3591.50 | ₹4592.25 |

| Adani Enterprises | ₹3.89 LCr | 40.35% | ₹2142.00 | ₹3457.85 |

| Suzlon Energy | ₹90.75 KCr | 85.69% | ₹33.90 | ₹86.04 |

| Tata Power Company | ₹1.44 LCr | 101.76% | ₹215.70 | ₹464.20 |

| Adani Power | ₹2.92 LCr | 192.93% | ₹231.00 | ₹797.00 |

| Bharti Airtel | ₹9.66 LCr | 51.59% | ₹1051.60 | ₹1779 |

| Tata Motors | ₹3.57 LCr | 72.86% | ₹557.70 | ₹1065.60 |

| Tata Power | ₹1.44 LCr | 75.52% | ₹230.80 | ₹494.85 |

Conclusion

NHPC Ltd. is a stable, dividend-paying company with strong fundamentals and significant market presence. However, the profit decline and revenue contraction in recent quarters demonstrate challenges in growth and efficiency. The company remains a reliable option for long-term investment, especially for investors looking for moderate returns with regular dividend income.

For long-term growth, NHPC needs to focus on expanding revenue streams, improving efficiency and reducing debt. With consistent cash flows and strong promoter holding, NHPC is a moderately safe bet for conservative investors, but growth-focused investors may consider other options in the power sector.

Disclaimer: The information provided here is for general informational purposes only and should not be considered as financial advice. Before making any investment, it is advisable to consult with a certified financial advisor. The author is not responsible for any investment decisions made based on this article.

Also Read:

Ola Electric share price target 2025, 2026, 2028, 2030, 2040, and 2050

FAQs

Q1. What is the NHPC share price target for 2025?

Ans: The expected share price target for NHPC in 2025 is between ₹48 to ₹120.

Q2. What is the NHPC share price target for 2030?

Ans: NHPC’s share price target for 2030 is projected to be between ₹160 to ₹276.

Q3. What is the NHPC share price target for 2040?

Ans: The share price target for NHPC in 2040 is expected to be between ₹450 to ₹646.

Q4. What is the NHPC share price target for 2050?

Ans: NHPC’s share price target for 2050 is likely to range between ₹736 to ₹1056.